Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

6 Sep, 2022

By Dylan Thomas and Annie Sabater

North America was already seeing rising private equity investment in renewable energy when the Inflation Reduction Act passed in August and added a slew of new, longer-term incentives for projects in the U.S.

The energy and climate provisions of the wide-ranging bill, signed into law Aug. 16 by President Joe Biden, are "changing the landscape" of renewable energy investment by enhancing and extending tax credits, said Michael Masri, a partner at Kirkland & Ellis LLP who specializes in tax law and renewables.

The law targets $369 billion for investing in energy and climate over the next decade. Tax credits for clean energy in the past often had a window of just a year or two. The bill's incentives for wind and solar projects, carbon sequestration, clean hydrogen and other technologies create a previously "unheard of" 10- to 15-year runway for investment, Masri said.

"People want to invest long term, and it's very hard, given what they've been doing historically, getting people comfortable that they could really hire people, invest in this space and know — with some level of stability — these credits will be around," Masri said.

The environmental, social and governance goals of investors were the primary force pushing private equity into renewables before the passage of the Inflation Reduction Act, or the IRA, Masri said. M&A in the sector, historically driven by strategic investors, has over the past 12 months been influenced by "a tremendous amount" of private equity-driven dealmaking, Masri noted.

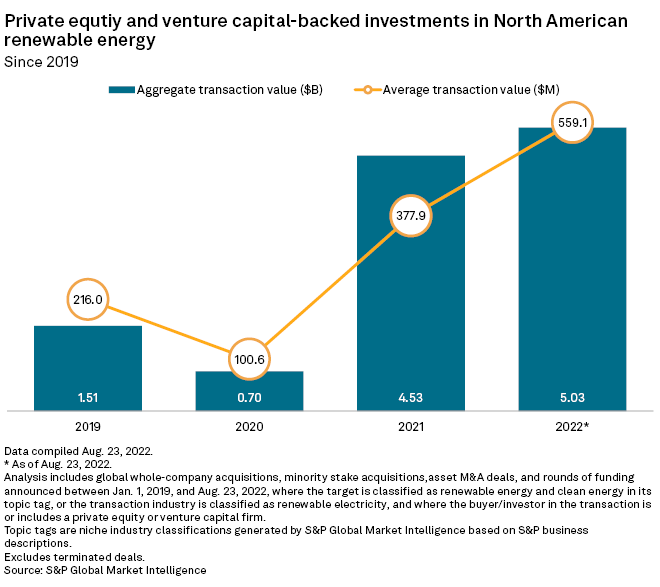

The deals include one of the largest renewable deals ever in North America, a US$3 billion equity investment in Invenergy Renewables LLC by listed private equity giant Blackstone Inc. and Canadian pension fund manager Caisse de dépôt et placement du Québec. That January deal helped push the total PE-backed investment in North America's renewable energy sector to $5.03 billion this year through Aug. 23, surpassing the 2021 full-year total of $4.53 billion.

"I think what you're going to see is like a slow ramp-up over the next two years of more and more money coming into the space," Masri said.

M&A impact

The IRA "could drive over $4.1 trillion in cumulative capital investment in new American energy supply infrastructure over the next decade," according to an analysis of the bill by REPEAT Project, a Princeton University-linked initiative to evaluate federal energy and climate policy.

James George Coulter, executive chairman and founding partner of listed private equity firm TPG Inc., cited that analysis on the firm's second-quarter earnings call, held just a week before the IRA became law.

"If that investment is going to happen, you probably have to at least double your money. So that's a very substantial potential profit pool for investments, and that should open the aperture of deals that will make sense for us given our high hurdle," Coulter said.

* Click here to download a spreadsheet of data featured in this story.

* Click here to read about the impact of the CHIPS Act on semiconductor investment.

* For more on global green energy investment trends in the first half of 2022, click here.

The firm in April closed its TPG Rise Climate LP fund, which targets climate solutions, at $7.3 billion. Coulter also described the IRA as a strong tailwind to TPG's existing portfolio investments.

"In our existing portfolio, probably 60% to 70% of what we've deployed was deployed assuming these incentives weren't in place, and it has a very positive effect on that deployment," Coulter said.

Masri said the new tax benefits for renewables are not only creating unexpected value for investors who placed their bets in the sector before the passage of the IRA, they are also likely to make entering the space more expensive.

"The sellers are going to want a premium. They're going to say, 'The bill is already in effect, and you should pay me for all these tax benefits,'" Masri added.